Table of Contents

What is softPOS technology? How is it enabling contactless payments and giving a much needed boost to SME merchant payments? Let’s find out.

The outbreak of the COVID-19 pandemic has brought millions of people into the digital payments arena giving the industry a big boost. Paying via e-Wallets, cards, and UPI has become the new norm.

According to Statista, India is set to record a total of over INR 239.66 billion digital payments by the end of FY 2021-22 as opposed to INR 20.7 billion in FY 2018-19.

However, the existing mechanics to accept digital payments are becoming obsolete. There’s an immense need for an interactive payment ecosystem that enables both merchants and consumers to benefit at every payment stage.

This is where softPOS comes in.

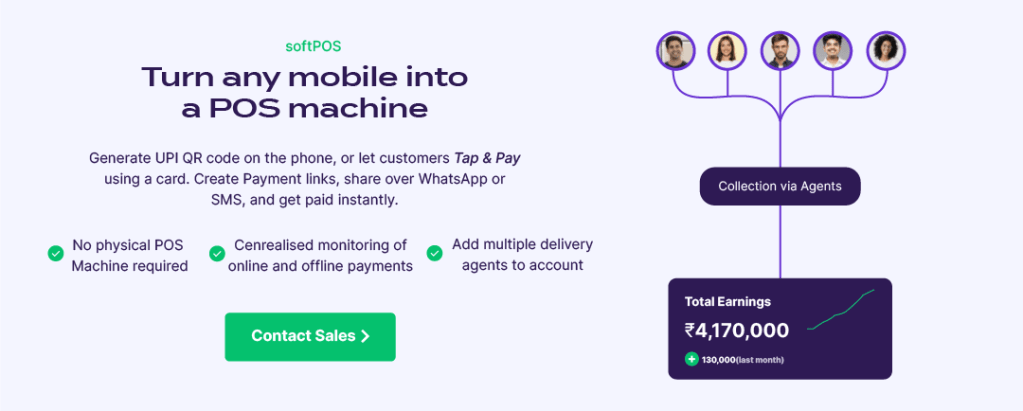

softPOS is the latest addition to the POS technology. Ideally, it’s an application that merchants can easily download on their smartphones and turn it into a payment accepting POS device.

In this blog, we’ll talk about,

- What is softPOS?

- Why business should opt for it

- How is it better than its counterparts – physical POS and mPOS systems

- How does it actually work?

- Who can leverage from this innovation?

- Challenges to softPOS adoption

Let’s get started.

What Is softPOS?

softPOS or software point-of-sale is an innovative system that leverages near-field communication (NFC) technology to commence transactions between consumers and merchants.

It allows merchants to convert their smartphones or tables into POS devices and eliminate additional investments such needed in the case of its predecessors.

This technology is especially revolutionary because it completely does away the need to manage additional hardware such as a card machine or physical POS devices.

Moreover, this fully software-based system does more than just accepting payments for merchants. It,

- Stores and processes payment information

- Generates payment receipts in real-time

- Generates detailed purchase reports

- Manages business inventory

- Offers discounts and promotions in real-time

Merchants can also easily customise the functionalities of their softPOS systems to suit their respective business needs.

While softPoS currently works on Android phones only, Apple is making necessary efforts to help merchants with iOS devices too to leverage the new software POS technology and accept payments seamlessly.

Reasons Behind Using softPOS For Business Payments

Any new innovation or technology gets accepted in the market only when it is easy to use, seamless, user-friendly, and supplements the existing system.

softPOS checks all these boxes and offers significant value to its stakeholders. Listed below are some rational reasons why businesses should use softPOS over its counterparts.

Widest Range Of Payment Modes

softPOS enables merchants to accept payments via multiple modes of payment. This not only increases the chances of conversions but ensures a better customer experience as well. Some payment modes include,

- Dynamic UPI QR code scanning

- Tap and pay using NFC technology

- Accept payments using payment links

- Record cash received at hand

Expands In-store Flexibility

With softPOS, merchants can significantly improve in-store customer shopping experience.

- Elimite queue bustling

- Offer a seamless checkout process

- Remove bottleneck of having limited/fixed number of checkout points

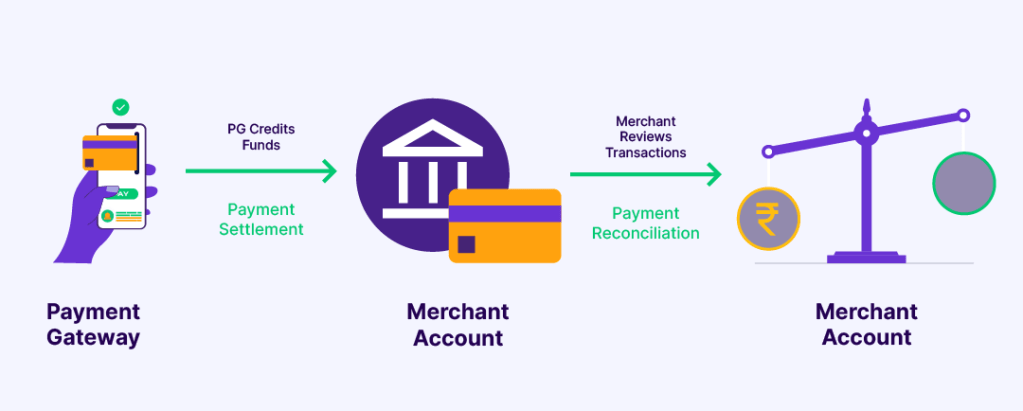

Easy Reconciliation

Unlike its counterparts, softPOS makes reconciliation easier and straightforward for merchants. They can easily switch between payment modes and record a high success rate.

Go Contactless With softPOS

With softPOS, merchants can leverage tap and pay technology along with other methods like payment links and QR code scanning. This helps to:

- Reduce cash reconciliations

- Reduce chances of error

- Record higher per-day transactions

- Reduce chances of viral and bacterial transmission

High Ease Of Use

softPOS is extremely customer and merchant friendly.

Customer can opt for contactless payments option through various modes. On the other hand, the merchant can easily accept payments themselves (and through agents) within minutes. No arduous training or expensive hardware is required

This helps in,

- Higher conversions and lower failed transactions

- Offering an excellent customer shopping experience

- Increasing average order value

- Building a loyal customer base

Allows Quick And On-the-move Checkout

Irrespective of a merchant’s business, softPOS gives them the leverage to accept payments even on the move. For instance, a food delivery agent can accept a payment using their softPOS-enabled smartphone while delivering an order to a customer.

Solves The Compliance Complexity

softPOS solutions such as one offered by Cashfree Payments follow all the necessary compliances.

This means, a merchant need not bury their heads into compliance rules and legalities. Rather, just download the application and start accepting payments right away.

Fits Every Pocket

The very nature, mechanics and technology used to build softPOS make it one of the easily adaptive, cheapest, and efficient options available in the market today for all kinds of merchants.

From small kirana shops to big department stores, everyone can leverage from softPOS and give their business an edge.

How Does softPOS Work?

softPOS is bridging the gap between the past and the future. It’s utilising the current card payment infrastructure to keep pace with the needs of the millennials.

It’s also making the payment accepting infrastructure available on smartphones and tablets that have become an integral part of people’s lives today.

Here’s a simple video explaining how merchants can download, install and start using the softPOS app by Cashfree Payments

softPOS by Cashfree Payments is,

- Highly sophisticated and fit to versatile use cases

- Customisable depending upon business needs

- Most cost-efficient option in the market

- Feature-rich and extremely easy-to-use

Features Of softPOS

- Touch-free payment via NFC antenna

- Mobile and server app rely on TLS 1.2+ channel

- SSL server authentication

- Mobile app authentication by authorisation and session data

- Complete operational security

- View transaction history according to payment statuses

- Give full and partial refunds, as required

- Offer discounts and cash backs in real-time

- Custom functions to suits business needs

Pro Tip: What are Co-branded Cards?

Physical POS Vs mPOS Vs softPOS

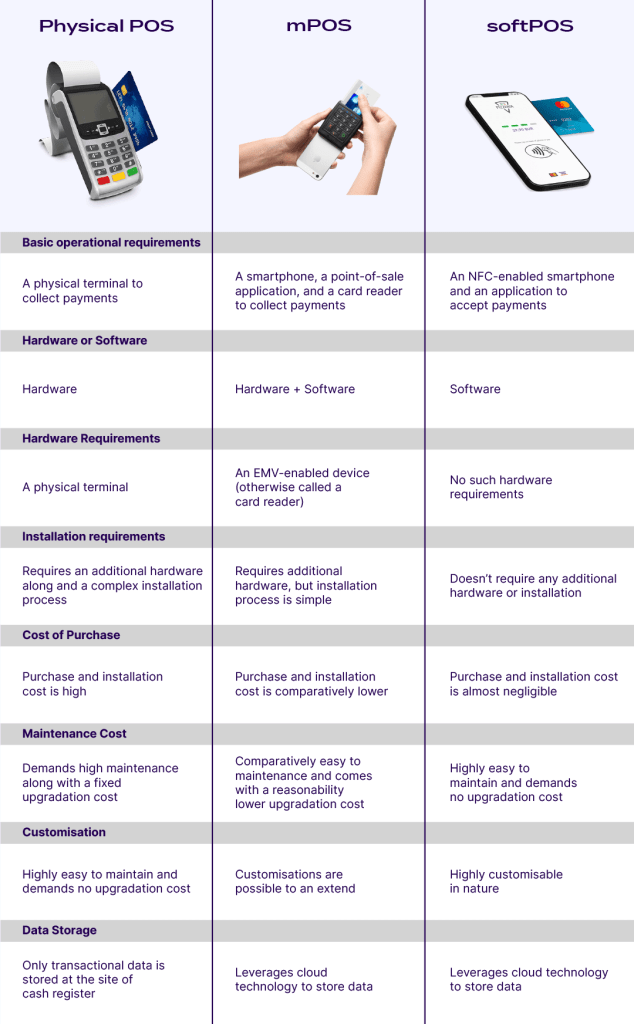

While physical POS systems were the first to be introduced to the market, mPOS and softPOS have only carried the legacy ahead. They’ve transformed into better and more convenient versions of their predecessors.

Here’s a table showing how physical POS systems have transformed into a more new-age, software-based POS system with Internet of Things (IoT) sitting in the epicentre.

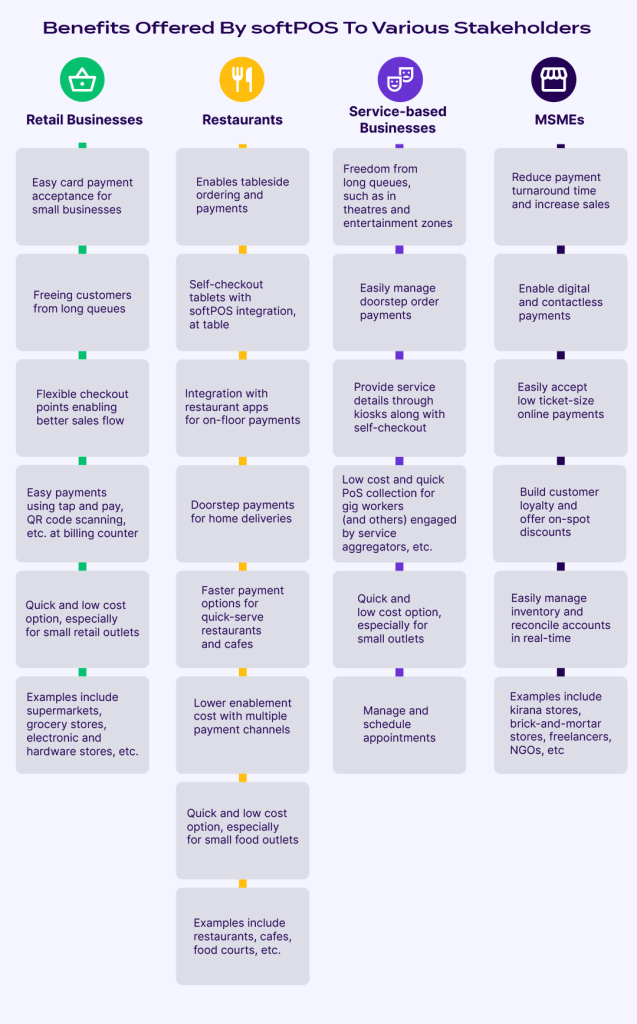

Who Can Use softPOS?

softPOS is perfectly suited for all types and sizes of businesses. From retailers, to delivery and courier services, small kirana shops, restaurants, and huge departmental stores, this carry-in-your-pocket device helps accept payments even on-the-go.

Benefits offered by softPOS across some key business domains are as follows.

Challenges Of Using softPOS

While there’s many upsides to switching to softPOS, it comes with its own list of challenges as well. Let’s take a look at them.

Not All Cards Are Contactless-enabled

Many existing cards aren’t contactless enabled. This means merchants using a softPOS machine cannot accept payments from cards which are contactless-enabled.

They would need to have an additional card reader attached to their smartphone to capture this segment of customers.

Not All Phones Are NFC-enabled

As understood, a merchant must have an NFC-enabled smartphone to use softPOS. This serves as a huge drawback for businesses who have phones otherwise. They’ll either have to buy an NFC-enabled smartphone or use an alternative to softPOS to accept digital payments.

Limited To Android OS Only

Recently, Apple has announced that it will allow iPhones to turn into POS machines as well.

However, at present, only those with an Android OS phone can use softPOS. Meaning, businesses or merchants that have Windows or iOS cannot leverage softPOS.

Long-term Upgradation Challenges

Although softPOS basically works by simply downloading an application on an Android smartphone, there are some long-term upgradation challenges that come alongside contactless technology.

As the technology matures and changes are made to smartphones themselves, the chances of sustainability of softPOS as a payment accepting tool comes with a question mark.

softPOS – An Untapped Opportunity

It’s clear that softPOS is a better and more sophisticated point-of-sale solution than its predecessors. Thousands of companies are already leveraging softPOS to empower their MSME business.

It’s especially enabling small merchants to do more than just accept payments. They can create digital catalogues, log transactions in an online book, reconcile accounts on the go and even attend to customer queries.

And, this is just the tip of the iceberg. Merchants will soon be able to leverage artificial intelligence and computer vision-powered technology to offer a “scan, check, and go” experience to their consumers. This also means a completely cashier-less shopping experience.

softPOS will not only help merchants to step up their A-game but leverage the technology to increase their sales and revenue exponentially.

Frequently Asked Questions

Yes, softPOS service providers like Cashfree Payments enables merchants to easily view payment history. They can search via a customer’s mobile number, invoice number and check their payment method, transaction status, and date as well.

Yes. Merchants can easily create dynamic QR codes on softPOS and share with the end-customers. This makes softPOS a highly dynamic payment accepting machine and captures a wider audience base that’s equipped to pay via QR codes today.